If the currency-inflexibility problem is not resolved, the forecast for (Q-DEBT) in the graphic above is for increasing problems, especially when future shocks create instability.

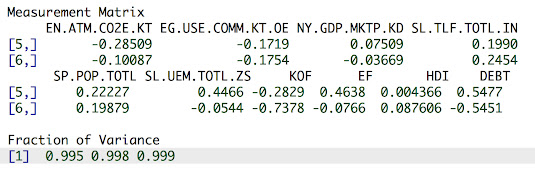

One question you might have is how important DEBT is to the French Economy. If we include DEBT in the Measurement Matrix (below) is doesn't become important until the Fifth and Sixth components and explains under 0.3% of the variation.

The two debt components, FR5 and FR6, capture the (DEBT+Unemployment+Ecological Footprint-KOF Globalization) and (L+KOF-DEBT) controllers, respectively.

Notes

The FR1 state variable was created from the following weighted indicators (the first row of the Measurement Matrix) and explain 98% of the variation.

The first six indicators are taken from the World Development Indicators (WDI). KOF = KOF Index of Globalization, EF = Ecological Footprint, HDI = Human Development Index. The second two components: FR2=(CO2+EF-KOF) and FR3 = (LU-L-N-HDI) describe environmental and Unemployment Error Correction Controllers (ECCs).

You can run the FRL20-BAU model here.

No comments:

Post a Comment