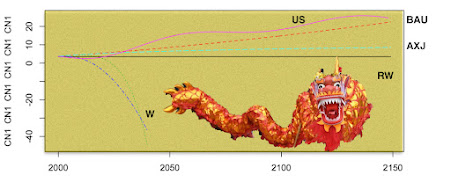

The Trump II Administration in the US has just attacked Iran and claims to have seriously damaged Iran's Nuclear Sites (here). Iran claims it will retaliate, but the future after the unprecedented attack using B2 Stealth Bombers and Bunker Buster Bombs remains unclear both for Iran, the US and Israel (who started the attacks on Iran). The future is unknowable and there is a lot of current speculation. I can use the IR_LM (Iran, Late Modern) model to project seven possible future scenarios for Iran (graphic above).

The Business-as-Usual (BAU) model is clearly the best and it forecasts unending exponential growth for the Iranian Economic System. The worst scenario is Geopolitical Alignment with China (CN) which leads to collapse. The scenario for alignment with Russia (RU), (light-blue dashed line) is quite cyclical and unstable. Alignment with the US produces stable growth out to 2100. The World System (W) and the EU Alignment models are not much better than a Random Walk (RW).

These seven scenarios suggest that Iran would prefer to be left alone to pursue its own future, but that seems unlikely to happen. Geopolitical Alignment with the US would also produce a desirable future, but that also seems unlikely to happen. Russia (RU) might be attractive in the very short run but that alignment will prove to be unstable. This leaves Iran with no desirable futures within the IR_LM BAU model.

You can experiment yourself with the IR_LM BAU model here. The period prior to the Iranian Revolution of 1979 sowed possibilities of alignment with the West, but after the Revolution the economy was converted into strong central planning aimed at Autarky (see the Economic History of Iran). In these circumstances, the IR_LM BAU model could be stabilized at any time by reducing growth rates (a counterfactual you can run here). Notice in the IR_LM BAU Model that the feedback controllers are dominated by Globalization, Unemployment, Ecological Footprint and Energy Use.

ChatGPT reports the following:

For more information about how the statistical models were constructed and estimated see the Boiler Plate.

The Axis of Evil

Further reading:

Iranian Revolution a series of events that culminated in the overthrow of the Pahlavi dynasty in 1979.

Strait of Hormuz a strait between the Persian Gulf and the Gulf of Oman. It provides the only sea passage from the Persian Gulf to the open ocean and is one of the world's most strategically important choke points.

Iran-Contra Affair a political scandal in the United States that centered on arms trafficking to Iran between 1981 and 1986, facilitated by senior officials of the Ronald Reagan administration

Iran Nuclear Program one of the most scrutinized nuclear programs in the world, has sparked intense international concern.

Pahlavi Iran the Iranian state under the rule of the Pahlavi dynasty. The Pahlavi dynasty was created in 1925 and lasted until 1979 when it was ousted as part of the Iranian Revolution, which ended the Iranian monarchy and established the Islamic Republic of Iran.

Iran-Iraq War an armed conflict between Iran and Iraq that lasted from September 1980 to August 1988. Active hostilities began with the Iraqi invasion of Iran and lasted for nearly eight years, until the acceptance of United Nations Security Council Resolution 598 by both sides.

Iranian Economy a mixed, centrally planned economy with a large public sector. It consists of hydrocarbon, agricultural and service sectors, in addition to manufacturing and financial services, with over 40 industries traded on the Tehran Stock Exchange.

The White Revolution a far-reaching series of reforms to aggressively modernize the Imperial State of Iran launched on 26 January 1963 by the Shah, Mohammad Reza Pahlavi, and ended with his overthrow in 1979.

Modernization Theory holds that as societies become more economically modernized, wealthier and more educated, their political institutions become increasingly liberal democratic and rationalist.

Foreign Policy of the Kennedy Administration The United States foreign policy during the presidency of John F. Kennedy from 1961 to 1963 included diplomatic and military initiatives in Western Europe, Southeast Asia, and Latin America, all conducted amid considerable Cold War tensions with the Soviet Union and its satellite states in Eastern Europe.

Blog Roll:

- Stabilizing the Iranian Economy Easy but not easy!

- A Deep Dive into the Iranian State Space Cycles vs. Control

- The Iranian Revolution Still being worked out today.

- Will Israel and US Attacks Hurt the World-System? Yes

- How Does the Iranian Economy Work? Not like a Neoclassical, free-market economy.

- What was the Impact of the Iranian Revolution? Elimination of Cycles!

- Iranian Globalization and Unemployment Created the discontent that led to the Iranian Revolution.