Economic Forecasting during and after the Great Recession took a devastating hit (here and here). Some of the criticism was deserved, others was not. The work of the IPCC provides a way forward. Let me apply the IPCC approach to forecasting the future of the US Economy.

First, when faced with the problem of predicting the future of Climate Change for the World-System, the IPCC acknowledges that the future is unknowable. If something is done to address Climate Change,

the future must be different than we can envision it right now. Policy must be able to change the future, but it well might fail. So, instead of making "best" forecasts, the IPCC constructed Emission Scenarios. Each of the scenarios is considered equal likely depending on what policy options are pursued (see the Boiler Plate for examples and links).

My approach to forecasting is a little different but conducted in the same spirit. I have a number of different models of the US Economy with different variables and covering different time periods (here). The models are based on Systems Theory (as are the IPCC Emission Scenarios--again covered in the Boiler Plate). The models produce many different output paths (forecasts) when different assumptions about input variables and estimated model coefficients are made.

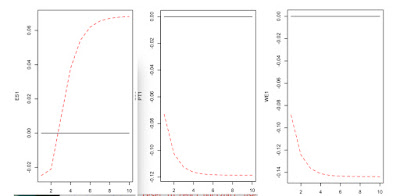

For this post, I'm just going to group a few of these outputs into three categories: Steady State, Growth-and-Collapse and Collapse. The time paths for these Business-as-Usual (BAU) models is presented in the graphic above.

None of the forecasts from my models would be considered acceptable by economic commentators. However, some forecasting models (for example the Atlanta Fed GDPNow model, which is based on an approach similar to mine), are starting to forecast collapsing growth rates (quarterly percentage change in GDP) for the US Economy.

My models begin forecasting in the year 2000 while the GDPNow models are as current as possible. Predicting collapse scenarios before the Subprime Mortgage Crisis should not be taken as predictions of Economic Crises. The Crises are largely unpredictable shocks to the system that should be presented along with any forecast using shock decomposition diagrams. The shocks are external to the model and cannot be predicted but the effects can be explored (I'll do that in a future post).

I don't know what information economic decision makers actually have or use. But, some of the current extreme policy measures being pursued by the Trump II Administration may (charitably) be interpreted as desperate measures taken in anticipation of growth-and-collapse scenarios for the US Economy.

Notes

If you would like to experiment with my models, the computer code is available here and can be run in a web browser presented with each code Snippet. Explanations about model construction are available in the Boiler Plate.