"What intrigues us as a problem, and what will satisfy us as a solution, will depend upon the line we draw between what is already clear and what needs to be clarified," Nelson Goodman.

State Space Models

Tuesday, November 26, 2024

US CO2 Forecasts: Will Trump II Make a Difference?

Thursday, November 21, 2024

US Inequality

Causes of Income Inequality

Monday, November 18, 2024

Hardship and the 2024 US Presidential Election

Hardship Index

Forecasting Model

Thursday, November 14, 2024

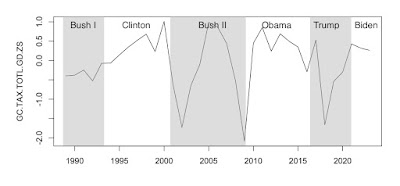

US Taxes

The assumption is that these cyclical tax cuts help the wealthy and fuel the deficit. I will look at the effects of tax cuts in a future post, but for the present I want to emphasize that tax cuts are both a political football and a countercyclical approach to balancing the economy. Tax cuts could probably be a more effective automatic stabilizer if politics was more rational.

Wednesday, November 13, 2024

Alternate Futures for the US

The graphic above (click to enlarge) shows four alternative futures for US1, an index of overall growth in the US SocioEconomic System (see the measurement matrix below). It is based on computer simulations of alternative estimated state space models. I would argue that the graphic says a lot about why US voters decided the way they did in the 2024 Presidential Election and what we can expect from the new, Right-Wing Republican Administration after 2025.

First, why did the MAGA movement embrace an extension of the American First isolationist movement? The Foreign Policy of the Obama Administration (2009-2017) was directed toward the World System and was not Isolationist. The World System input model (W) in the graphic above put the US on a slower overall growth path (dotted green line). I would argue that voters were well aware that growth of the US Economy and the US standard of living was slowing (see Economist Kathryn Ann Edward's comments here). The realization led to a Right-Wing backlash (the same thing that happened in Germany during the Inter-War (WWI-WWII) Years, see Arno Mayer's The Persistence of the Old Regime).

Second, the President-elect's policy pronouncements and transition plans suggest abandoning the World System and doing everything possible to stimulate unlimited endogenous economic growth in the US: eliminating regulation, ignoring white-collar crime, closing borders to immigrants, abandoning environmental regulation (allowing businesses to exploit free environmental resources), eliminating labor regulation (a restraint on profits), dismantling the Welfare State, slashing business taxes (another restraint on profits), eliminating funding for and control over education (a stimulus to wage growth and a limit on profits), etc.

The red and the blue dashed lines in the graphic above show possible time paths for the US Economy unleashed. The models predict uncontrolled, unending exponential growth for the US System. They are, I would argue, a business man's fantasy. Nothing can grow forever and eventually limits will be reached (my models suggest sometime after 2050). Most of us living at the present moment, me included, will be dead by then. It will be someone else's problem.

There is another possible time path for the US SocioEconomic System: the Random Walk (RW, the solid line in the graphic above). No one can know the future. Attempts to dismantle failing US Institutions may or may not happen as imagined. The new Administration's cabinet picks, so far, are not reassuring. Essentially, in a Random Walk, today is like yesterday except for random error, actions by people who are making it up as they go along.

I am always surprised that commentators can seem so confident about what happened in the 2024 Presidential election and what will happen as a result of it. I'm not. My advice for the future is to take defensive positions and not follow Economic Bubbles that might develop in response to crippling of US regulatory institutions.

We know our current systems are failing and need to be rebuilt. In future posts I will look more carefully at all of these systems.

US Measurement Matrix

The graphic at the beginning of this post applies the weights from row [1,] of the state space measurement matrix to 36 indicators of US development from 1950-2010. After 2010, the results are simulated from four state space models: RW (Random Walk), W (World System input), US (components from rows [2,] and [3,] in the measurement matrix), and BAU (a Business as Usual model with no inputs).

Measurement Matrix

L.US.E. L.US.U. GDP.US. GDP.C. GDP.I. GDP.X.

[1,] 0.1955 0.138 0.1978 0.1972 0.1961 -0.1402

[2,] 0.0669 0.200 -0.0462 -0.0554 -0.0355 0.0751

[3,] -0.0312 0.239 0.0284 0.0314 -0.0272 0.2229

GDP.G. P.US.TBILL. P.CPAPER. P.FED.FUNDS. P.CPI.

[1,] 0.1976 0.00429 -0.01554 0.0127 0.19773

[2,] -0.0377 0.40583 0.40460 0.3998 0.00996

[3,] 0.0541 0.07630 -0.00165 0.0986 0.02128

P.GDP. P.SP500. V.NYSE. P.S.P.DPR. P.S.P.EPR.

[1,] 0.1967 0.1868 0.166 -0.146 -0.112

[2,] 0.0337 -0.1076 -0.131 0.144 0.128

[3,] 0.0240 -0.0277 0.165 0.321 0.384

Q.H.Starts. K.US. M1 M2 P.WPI. Q.A.

[1,] -0.0202 0.1974 0.1953 0.1979 0.1932 0.1918

[2,] 0.0392 -0.0418 -0.0145 -0.0325 0.0612 0.0766

[3,] -0.4666 0.0446 -0.0318 0.0472 0.1051 -0.0973

Q.I. O.B. P.FUELS. P.W.AG. P.W.MFG. Q.OIL.

[1,] 0.1967 -0.173 0.1834 0.1983 0.1990 -0.113

[2,] 0.0374 0.186 0.0269 0.0131 0.0125 0.312

[3,] -0.0683 0.110 0.2538 0.0489 0.0232 -0.145

N.US. IMM.US. U.US. CAPU EF Globalization

[1,] 0.1951 0.1440 0.1967 -0.141 0.1867 0.0818

[2,] 0.0746 0.0546 0.0477 -0.153 0.1096 -0.2964

[3,] -0.0642 -0.1371 -0.0589 -0.164 0.0303 0.3905

CO2 Q.FOSSIL.

[1,] 0.180 0.129

[2,] 0.155 0.283

[3,] -0.110 -0.157

Fraction of Variance

[1] 0.698 0.854 0.900

Atlanta Fed Economy Now

Hurricane Forecasting

Climate Change

Tuesday, November 5, 2024

Is the US Presidential Election a Random Walk?

Data and Sources

Monday, November 4, 2024

Are Migrants Stealing Your Jobs?

In summary, while there can be local variations, the data does not support a general link between higher immigration and increases in either unemployment or crime.

Interestingly, AI does not agree with Political Intelligence here. For example, the Heritage Foundation, a Right-Wing Think Tank, argues that "...2/3 of Federal Arrests involve non-citizens". Of course, both ChatGPT and the Heritage Foundation have biases because they base their conclusions on very limited data and biased mental models. So, the assertions and arguments don't satisfy me.

In the causal diagram above (click to enlarge), I try to make some links that are missing from the literature which concentrates almost entirely on presenting numbers for Net Migration, Employment, Unemployment, Crime and Healthcare. My working hypothesis is that all these variables are being driven by Shocks and internal dynamics within the US Economy and the World-System. Causal links with "?" indicate that the direction of causation is unclear, at least to me.

First, let me summarize my results before getting into details. The models I will use are similar to the Atlanta Federal Reserve's Economy Now model but I've expanded the variables of interest to include Crime, Net Migration and Healthcare (the EconomyNow app, which you can download on your cell phone, covers GDP, Wages, Employment and Consumer Prices). It's the same model I have used in prior post (here and here). To summarize my findings:

- Crime Crime rates have been declining since 1974 with 1981 being the peak for violent crime rates. In the short run, crime rates are a random walk or driven by US Economic performance. In the long run, crime rates are driven by the World-System, particularly events in Latin America (this result should appeal to the Right-Wing). But, it is not driven by immigration.

- Government Healthcare Expenditure In the short-run, healthcare expenditure is also a random walk and driven by events in the World-System. It also is not driven by immigration.

- Unemployment In the short run, and the long run, unemployment is driven by events in the US Economy and not by immigration.

- Net Migration For net migration (more people entering than leaving the country), I don't get a very clear picture (this is probably why it is a perfect issue for wild political distortions). The best model is a Business-As-Usual (BAU) model, likely the result of US immigration restrictions. However, it does not support the assertion that the US has Open Borders.